Alternative Investment Funds (AIFs) in India are divided into three categories, with Category I AIFs concentrating on investments in early-stage firms, social ventures, and infrastructure. Angel Funds and Venture Capital Funds (VCFs) are particularly important in promoting innovation and entrepreneurship.

What Are Angel Funds and Venture Capital Funds?

Angel Funds

Angel Funds are a subset of Venture Capital Funds that cater to high-net-worth individuals (HNIs) and institutional investors wishing to invest in early-stage firms. These funds collect funding from accredited investors (sometimes known as angel investors) and distribute it to potential entrepreneurs.

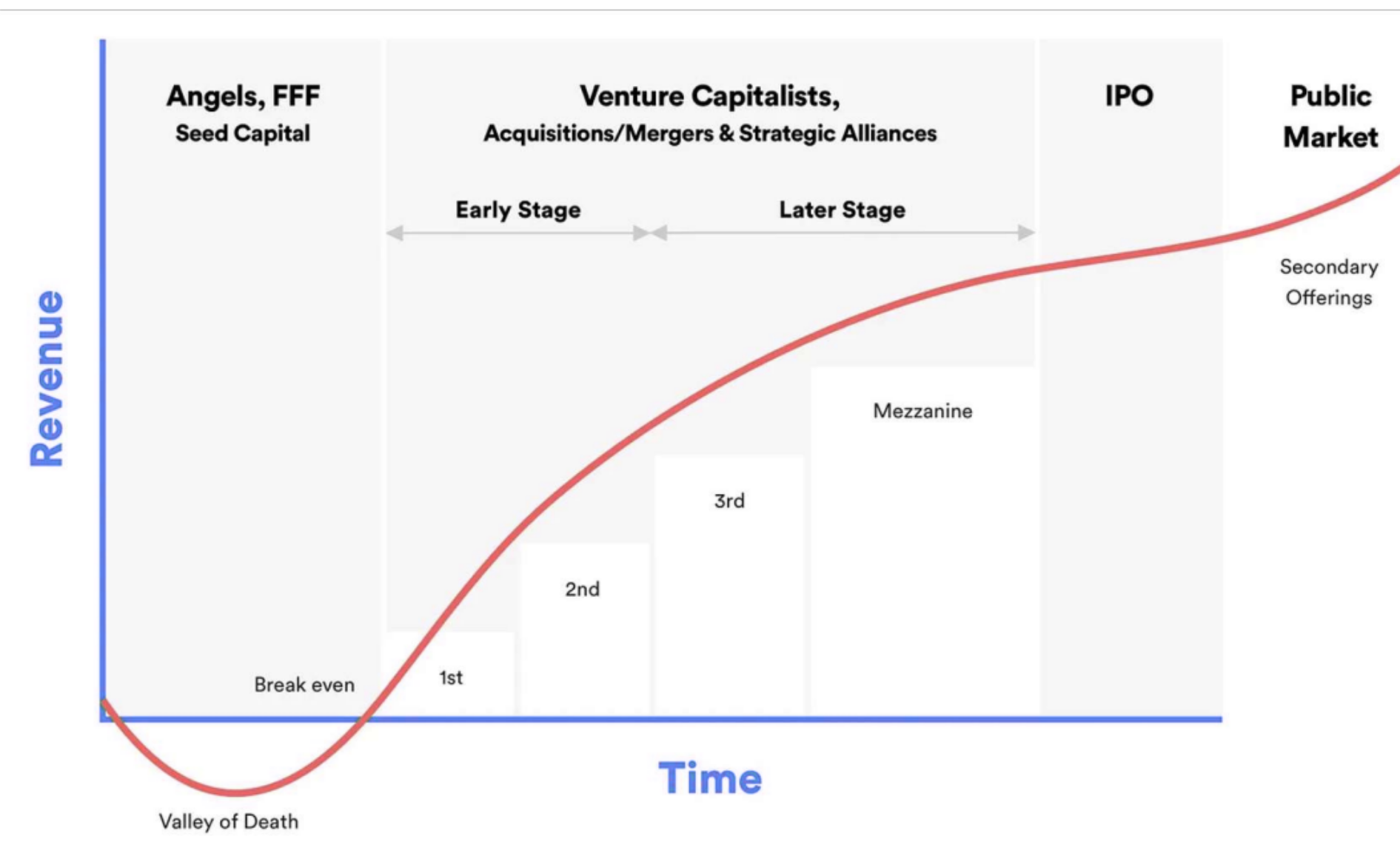

- Investment stage: Pre-seed and seed stage companies.

- Minimum investment: ₹25 lakhs per investor.

- Funding Structure: Typically established as a trust or LLP.

- Exit Strategy: Acquisitions by larger enterprises, IPOs, or follow-on Funding

Venture Capital Funds

VCFs are professionally managed funds that invest in early- to growth-stage firms with significant growth potential. Unlike angel funds, these funds are designed for institutional and high-net-worth investors looking for broad exposure to a variety of firms.

- Investment stage: Seed to late-stage startups

- Minimum investment: ₹1 crore per investor.

- Funding Structure: Structured as LLPs, trusts, or corporations.

- Exit Strategy: Initial public offerings, mergers, and secondary sales

How Do These Funds Work?

- Capital Pooling: Investors contribute capital to the fund, which is professionally managed.

- Startup Selection: Fund managers conduct due diligence and invest in high-potential startups.

- Growth Support: Funds offer financial and strategic support to investee companies.

- Exit Strategy: The fund generates returns for investors through successful exits such as IPOs or acquisitions.

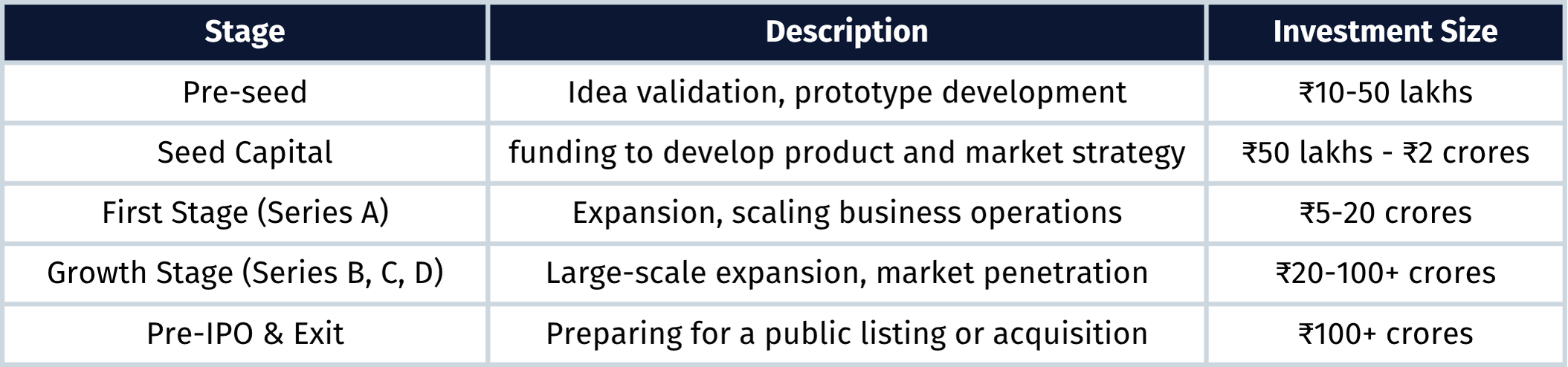

Timeline of Investment Stages

Both Angel Funds and Venture Capital Funds are critical vehicles for startup financing under Category I AIF. While Angel Funds specialize in early-stage investments, VCFs offer structured finance across various growth phases. These funds are critical to supporting India's developing startup ecosystem and providing investors with high-growth prospects.

Investors should carefully consider risk concerns, investment timelines, and exit alternatives before investing in these funds.